What Today’s Customers Really Want: 5 Shifts SMBs Can’t Afford to Ignore

Small and mid-sized businesses (SMBs) are facing a growing challenge: customer expectations are shifting faster than ever. What worked five years ago doesn’t always work today, and consumers are making choices based on far more than just price or

Consumer Confidence Is Rising—Here’s How SMBs Can Ride the Wave (and Stay Ahead of Uncertainty)

North American SMBs are cautiously optimistic. According to the NFIB Small Business Optimism Index, sentiment climbed to 98.8 in May 2025, surpassing the long-term average of 98 for the first time in several months. While this uptick reflects renewed

Scaling Up? Here’s Why Accounting Integration Should Be at the Top of Your POS Wish List

Growing a small business is exciting—but let’s be honest, it’s also a lot to manage. Whether you're opening a second location, adding new employees, or simply trying to get a clearer picture of your finances, one thing becomes clear

Stronger Teams, Better Sales: Building Retail Culture That Lasts

A strong team culture is a powerful asset for any retailer or food-service business. When employees feel valued, aligned with a clear mission, and part of a supportive team, they tend to stay longer and work harder. In fact,

Leverage Your Point of Sale System This Back to School Season

Back‑to‑school is the second‑largest retail season after the winter holidays, with U.S. families projected to spend nearly $39 billion on K‑12 supplies and $87 billion on college‑related items in 2024. Leveraging modern POS tools—for inventory management, dynamic pricing, real‑time analytics, and

The Hidden Costs of Free POS Systems: What You’re Really Paying For

“Free POS system? That’s perfect—I love free stuff!” We get it. When you’re juggling payroll, rent, marketing, and inventory, a free point-of-sale system can sound like a gift from the business gods. But let’s get real for a second:

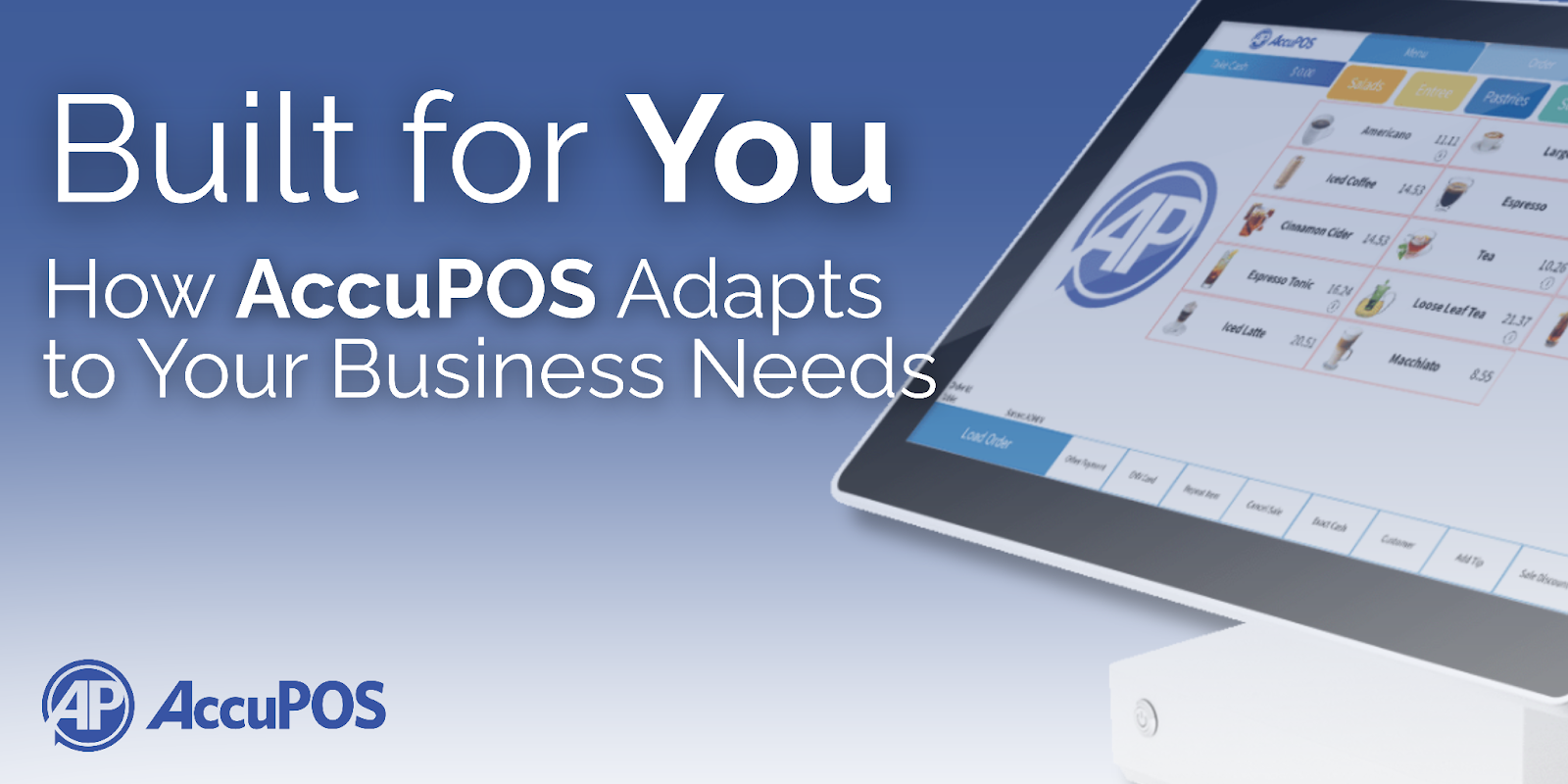

Built for You: How AccuPOS Adapts to Your Business Needs

Looking for a POS system that fits your unique business? You’re not alone. Many small and midsize business owners feel frustrated with point-of-sale systems that are too rigid, too complex, or just not made for their type of business.

Understanding Point-of-Sale Systems for Brick-and-Mortar Businesses

In a world where every second counts and customer expectations are sky-high, you can't afford to be stuck with outdated cash registers. Imagine a tool that not only speeds up transactions but also gives you real-time insights into your

Fresh Strategies to Keep Your Membership Club Thriving This Summer

Summer can be a challenging time for membership clubs as engagement and retention often dip during vacation season. However, with the right strategies, you can turn the summer slump into an opportunity for growth. In this post, we’ll explore

Loyal Customers, Bigger Profits: How the Right Loyalty Program Transforms Your Business

It’s a competitive market and small and mid-sized businesses need every advantage they can get. One of the smartest investments a business can make is implementing a customer loyalty program. Not only can these programs increase profits, but they

Key POS System Features Every Membership Club Needs to Streamline Management (and Boost Retention)

Running a successful membership-based business — whether it’s a gym, a co-op, a private club, or a community center — requires more than just great facilities. Strong membership management and seamless customer experiences play a huge role in keeping

Outshining E-Commerce Giants: How Small Stores Can Win with Service and Community

Sure, small businesses are facing an uphill battle against major chains and online giants like Amazon and Walmart. These large corporations have extensive resources, competitive pricing, and expansive supply chains, making it difficult for independent retailers to compete on

The Hidden Costs of Manual Data Entry: Why Automation Is More Than Just a Time Saver

As a small business owner, you're constantly juggling various tasks to keep your operations running smoothly. From managing inventory to processing sales and tracking customer data, your workload can be overwhelming. However, many business owners still rely on manual

3 Key Benefits of Integrating Your POS System with Accounting Software

Efficiency and accuracy are crucial for success in any business. One of the smartest investments a business can make is integrating its Point-of-Sale (POS) system with accounting software like Sage or QuickBooks. This integration can significantly enhance financial management,

Top 5 Upgrades Business Owners Should Consider During Tax Season

Tax season is not just about crunching numbers—it’s a golden opportunity to invest in your business and set it up for success. Strategic upgrades during this time can enhance efficiency, improve customer satisfaction, and position your business for growth.

The 4 Biggest Challenges Facing Brick-and-Mortar Game Stores in 2025—and How to Overcome Them

The gaming industry has evolved significantly over the years, and in 2025, brick-and-mortar game stores remain an integral part of the community for gamers and hobbyists alike. However, these businesses face unique challenges in an increasingly digital and competitive